Minimum Corporate Income Tax (MCIT) Rates for Taxable Years …

2024年3月14日 · Under the CREATE Act, the prescribed MCIT for the period July 1,2020 until June 30, 2023 is one percent (1%). Effective July 1, 2023, the MCIT rate reverted to its previous rate of two percent (2%) based on the gross income of the corporation.

Philippines - Corporate - Taxes on corporate income

2024年8月1日 · Minimum corporate income tax (MCIT) on gross income, beginning in the fourth taxable year following the year of commencement of business operations. MCIT is imposed where the CIT at 25% is less than 2% MCIT on gross income.

Corporate Income Tax In The Philippines [Latest: 2025]

2024年10月22日 · Corporate income tax rate in the Philippines is 25% for domestic and non-resident foreign corporations. Minimum Corporate Income Tax (MCIT) is temporarily reduced to 1% until June 30, 2023. Taxable income includes profits from business activities, gains from asset sales, interest, and dividends.

Features of Minimum Corporate Income Tax in Philippines

Under the Tax Code of the Philippines, a minimum corporate income tax (MCIT) in the Philippines of two percent (2%) of the gross income is imposed upon any domestic or resident foreign corporation beginning the fourth (4th) taxable year immediately following the taxable year in which such corporation commenced its business operations.

CREATE Law – Tax Rate Changes Effective July 1, 2023

2023年7月1日 · Because of CREATE law there is a temporary reduction on the rate of Minimum Corporate Income tax from 2% to 1% from July 1, 2020, to June 30, 2023. To illustrate the benefit of this reduced rate, let us say you had the following Gross Income from January to December 2022 of P1,000,000.

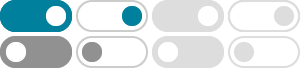

In computing the MCIT, the gross income shall be divided by 12 months to get the average monthly gross income and apply the rate of 1% for the period January 1 to June 30, 2023; and 2% for the period July 1 to December 31, 2023. For ease of computation, the rates below corresponding to the taxable period of the taxpayer may be used: Annual

Navigating Tax Changes: Understanding MCIT Rates for 2024

2024年3月12日 · What are the changes in MCIT Rates under RMC 36-2024? The Corporate Recovery and Tax Incentives for Enterprises Act, effective from July 1, 2020, until June 30, 2023, mandated a One Percent (1%) MCIT. However, starting July 1, 2023, the MCIT rate reverted to its original Two Percent (2%) based on the corporation’s gross income.

Corporate Income Tax Philippines [Simplified for 2025]

The corporate tax rate in the Philippines is 25%, with a minimum corporate income tax (MCIT) of 2% on gross income. However, until June 30, 2023, the MCIT is temporarily reduced to 1%. There are lower tax rates available for corporations with net taxable income under 5 million PHP and total assets below 100 million PHP.

Corporate Tax 2024 - Philippines - Chambers and Partners

The corporate income tax rate is 25% while the minimum corporate income tax (MCIT) is 2%. A lower corporate income tax of 20% is also provided for domestic corporations with net taxable income not exceeding PHP5 million and with total assets not exceeding PHP100 million, excluding land on which the corporation’s office, plant and equipment ...

Corporate Income Tax in Philippines: Rates & Incentives | Acclime

Beginning in the fourth taxable year of operations, domestic and resident foreign corporations are subject to a minimum corporate income tax (MCIT) of 2% of gross income, except for 1 July 2020 to 30 June 2023, when the MCIT is 1%.